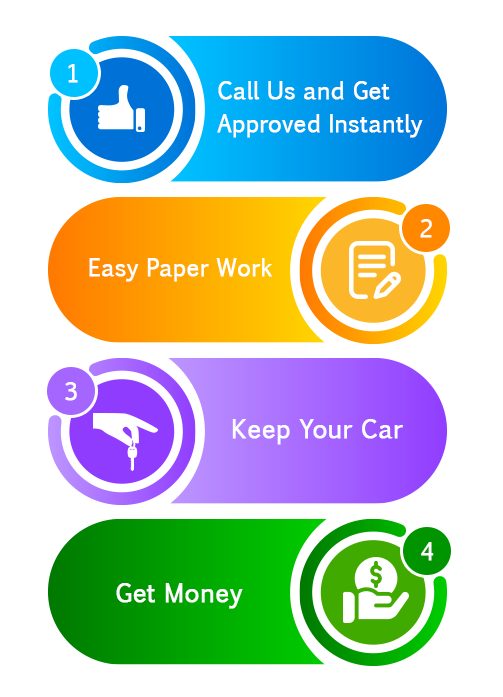

Application Process

1. Call Us or Apply Online!

Instant Loans Canada will help you go through our simple and easy loan process, all you have to do is give us a call or apply through our online application! It only takes 10 minutes, so get started today!

2. Simple Paperwork

With us, filling out paperwork is a cinch. Our simple online application form only requires basic information or you can call us and we will go over it with you!

3. Hold On To Your Car

After everything is completed you will receive your cash and off you go! Keep your vehicle even during the loan with us, we don’t do any type of storage or hold on to your vehicle!

4. Obtain Cash

We can lend between $1000 to $50,000. The loan amount is determined by the wholesale value of your car. Among the factors that we consider are the year, make, model, mileage and condition of the vehicle. Fill out the online auto title loan application now!

Requirements

- Vehicle Title (vehicle must be paid off and in your name)

- Driver’s License (name must match the name on the title)

- The Vehicle (it must be inspected prior to receiving your loan)

More information

Loan Fees:

The fees consist of an Auto Check (to check for accidents and vehicle origin), Lien Search (to make sure the vehicle is free and clear of all liens), and a Vehicle Inspection / Evaluation.

Loan Source & Renewal Policy:

Instant Loans Canada locates finance companies that provides 2-5 year term loans with the lowest annual interest rate. There are no prepayment fees for early repayment of the loan.

Implication of late payment or non payment

In the event of a late or partial payment, interest fees will be charged on a daily basis on the outstanding amount. Failure to pay will result in legal action, as per Personal Property Securities Act (PPSA) British Columbia, Alberta, Saskatchewan, Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland & Labrador and Ontario.